Renzo Protocol & the Future of DeFi: Risks, Rewards, & Realities

ChainRisk deep dived into a recent research paper published on the economic risks of Renzo Protocol. This blog is to highlight major inferences & conclusions from the actual research paper.

The total value locked (TVL) in EigenLayer has grown rapidly to approximately $19.5 billion; however, the total value redeemable (TVR) is only about two-thirds of the reported TVL, highlighting potential vulnerabilities & risks. Renzo's protocol allows for leveraged restaking of liquid staking tokens, more than doubling returns compared to leveraged staking alone, but loans collateralized by Renzo’s liquid restaking token (ezETH) are susceptible to liquidation if ezETH depegs.

Given that the majority of staking is on Ethereum, any stress events from depegs could disrupt all protocols involved with staking & restaking on Ethereum & EigenLayer, spreading credit contagion throughout the DeFi ecosystem & potentially leading to another DeFi winter. This report has been heavily inspired & adapted from C. Alexander’s recent paper “Leveraged Restaking of Leveraged Staking: What are the Risks?”

Staking in Ethereum

In PoS blockchains, participants can stake their native tokens to run validator nodes, which propose & attest to the next block in the blockchain. In return, they earn rewards consisting of newly minted tokens & transaction fees. Tokens staked directly on the network are locked & cannot be traded or used as collateral.

Liquid staking protocols provide a solution to the locked token problem. When a staker deposits native tokens into a liquid staking protocol, they receive a fungible liquid staking token (LST) in return. LSTs can be used for trading or as collateral in other decentralized finance (DeFi) protocols, making staking more flexible & capital-efficient. By depositing ETH in Lido, stakers receive stETH tokens, which can be used as collateral or for trading while still earning staking rewards.

.png)

stETH is a rebasable token, meaning its quantity in the staker’s wallet increases daily to reflect accrued rewards, which can complicate its use in some DeFi protocols. Leveraged staking involves using LSTs as collateral to borrow more native tokens, which are then staked again to receive more LSTs. This process, known as looping or folding, can be repeated multiple times to amplify staking rewards. A common strategy involves using Lido’s stETH as collateral on Aave to borrow more ETH, which is then staked again via Lido, leveraging the initial investment multiple times.

Restaking is a recent development where tokens are staked on platforms like EigenLayer instead of directly on Ethereum. These platforms allow staking to support various actively validated services (AVS) within the Ethereum ecosystem. Restaking can offer higher rewards due to additional slashing risks associated with validating these services. EigenLayer, for example, imposes higher slashing penalties to compensate for the increased risk, but this also means that restakers need to carefully manage these risks.

TVL measures the value of assets managed by a DeFi platform. However, this can be double-counted in liquid staking & restaking processes, where the same assets are counted multiple times across different protocols. Renzo Protocol is a major liquid restaking protocol, contributing to EigenLayer’s TVL. In the upcoming discussion, we will discuss the double-counting issue, where the same ETH can be counted as TVL on multiple platforms. LSTs & restaking tokens can depeg from their native token prices due to various factors, including market manipulation & low liquidity in decentralized exchanges (DEXs). Depegging can trigger liquidation cascades, where collateralized loans become undercollateralized, leading to forced liquidations & further price drops. This could lead to widespread credit risks & potential contagion across the DeFi ecosystem, affecting multiple protocols.

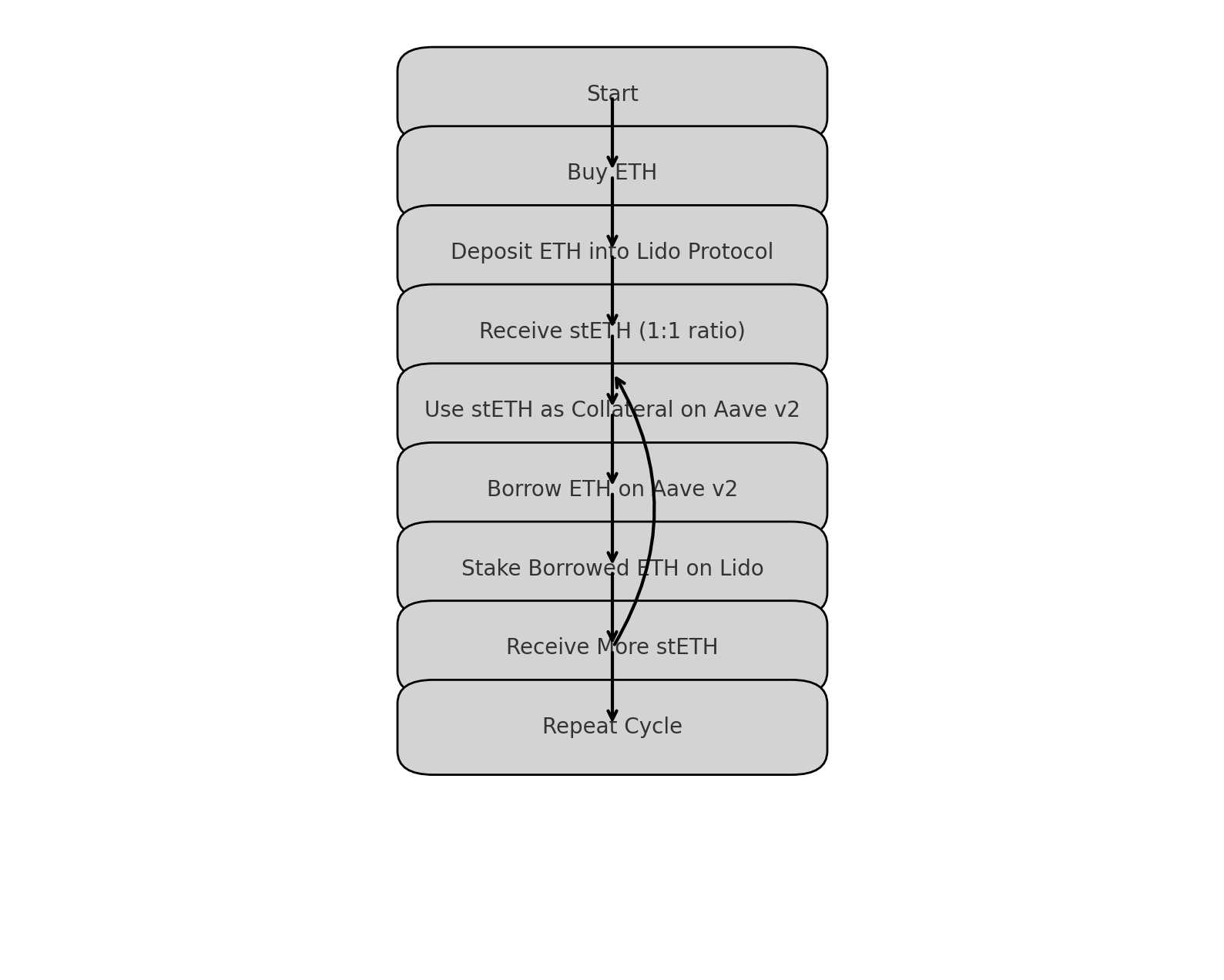

Leveraged Liquid Staking

Leveraged liquid staking involves using liquid staking tokens (LSTs) as collateral to borrow more of the native token (e.g., ETH), which is then staked again to receive additional LSTs. This process can be repeated multiple times to amplify the returns from staking rewards.

- Initially, a user buys ETH & deposits it into the Lido protocol.

- The user receives stETH in a 1:1 ratio for every ETH deposited.

- The stETH is used as collateral to borrow more ETH on a lending protocol like Aave v2.

- The borrowed ETH is then staked again on Lido, receiving more stETH, which can be used as collateral again.

This loop can be repeated several times to leverage the initial ETH deposit many times over. Leveraged liquid staking can significantly increase staking rewards by repeatedly using stETH as collateral to borrow & stake more ETH. Increased leverage comes with higher risks, particularly the risk of liquidation if the price of stETH depegs from ETH. The total value locked (TVL) in DeFi protocols can be overestimated due to the recursive nature of leveraged staking.

Mathematical Formulation of Leveraged Liquid Staking

Total Staked Value Calculation

- Total Leverage: 217.32 ETH

- Initial Outlay: 100 ETH

- Leverage Ratio: 217.32/100=2.17X

Funding Cost Calculation

- Net Leverage: (217.32 -11.73)/100 =2.06X

Points to be Noted

- Total Leverage: The total amount of ETH staked, including borrowed amounts, which is 2.17 times the initial 100 ETH investment.

- Funding Cost: The interest paid to Aave for borrowing ETH, totaling 11.73 ETH.

- Net Leverage: The effective leverage after accounting for funding costs, resulting in a leverage of 2.06 times the initial 100 ETH investment.

This Table reports 20 rounds of leveraged staking using an initial capital of 100 ETH, each round having an LTV of 70% when the stETH price is 0.99

Observation:

- Summing the column labeled "Lido" gives 326 ETH staked in total, so the leverage is 3.26X not counting the funding cost.

- Continuing for further rounds of restaking increases the leverage, eventually converging to a maximum leverage of 3.33X after many rounds (ignoring the funding cost).

- The TVL (Total Value Locked) in Lido is counted as 326 ETH, while the original stake was only 100 ETH.

- The real TVL added to Lido should be 100 ETH, & the real TVL on Aave v2 should be zero, not 322.27 ETH.

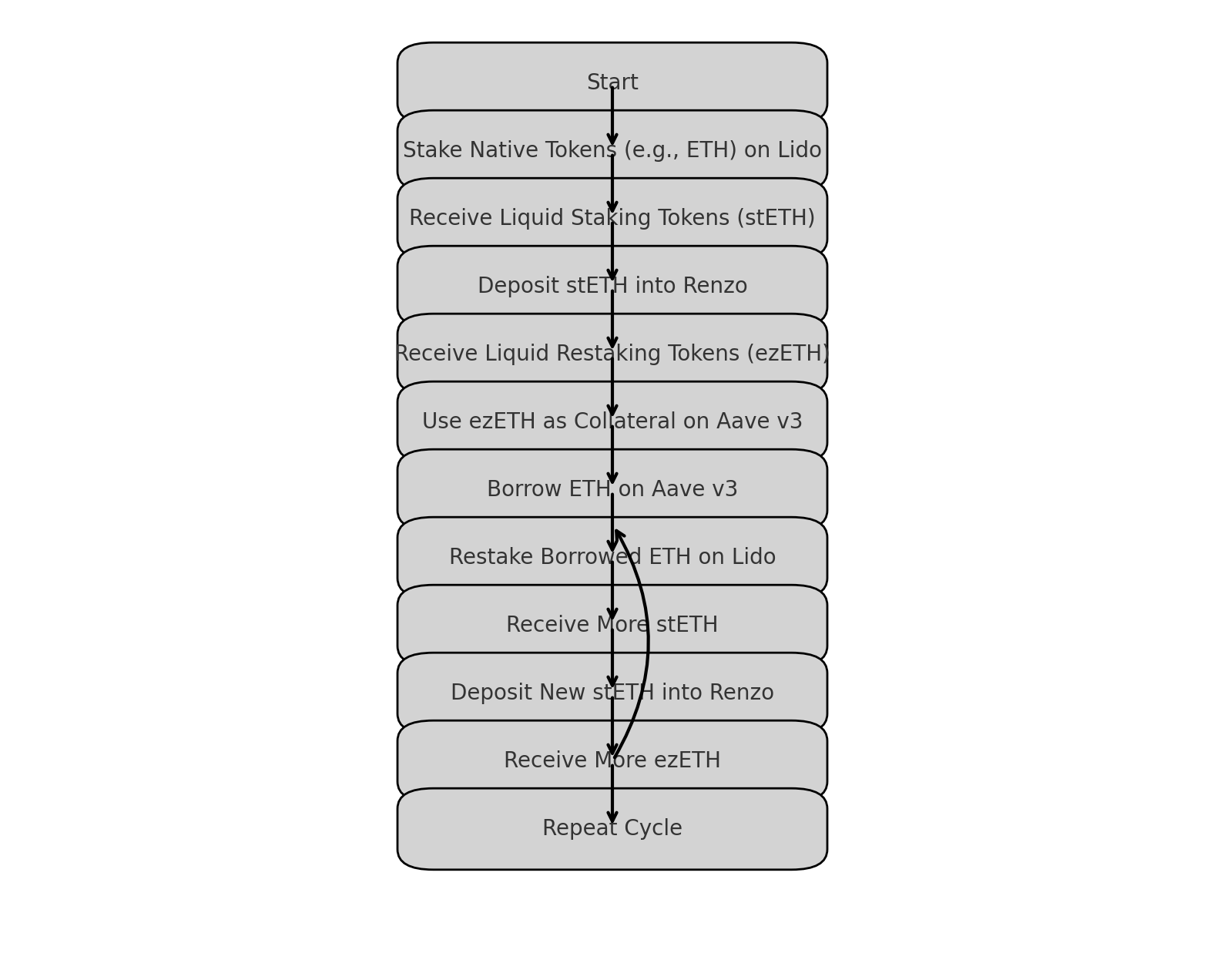

Leveraged Restaking

Leveraged restaking is a strategy that builds on leveraged staking by adding an additional layer of complexity & potential returns. This strategy involves staking assets on a Proof-of-Stake (PoS) blockchain through a liquid staking protocol, such as Lido on Ethereum, to receive liquid staking tokens (LSTs). These LSTs can then be used as collateral to borrow more native tokens (e.g., ETH), which are restaked to receive more LSTs, & this process is repeated multiple times to leverage the staking position.

- Start by staking native tokens (e.g., ETH) on a liquid staking protocol (e.g., Lido) to receive an equivalent amount of liquid staking tokens (LSTs), such as stETH. Example: 100 ETH staked on Lido yields 100 stETH.

- Deposit the LSTs (stETH) into a restaking protocol like Renzo to receive an equivalent value in liquid restaking tokens (LRTs), such as ezETH. The value is determined based on the oracle price of the LST & LRT at the time of deposit. Example: 100 stETH might be converted into 150 ezETH if the conversion rate is favorable.

- Use the LRTs (ezETH) as collateral on a lending protocol like Aave v3 to borrow more native tokens (ETH). The amount borrowed is determined by the Loan-to-Value (LTV) ratio, which is typically a percentage of the collateral value. Example: With a 70% LTV, 150 ezETH might allow borrowing 105 ETH.

- The borrowed ETH is restaked via the liquid staking protocol to receive more LSTs. These new LSTs are again deposited into the restaking protocol to receive more LRTs. The process is repeated multiple times to maximize the leverage. 105 ETH restaked to get 105 stETH, converted to 157.5 ezETH, & used to borrow more ETH, continuing the cycle.

Leveraged restaking can significantly amplify the returns from staking by generating multiple streams of income from both the staking & restaking rewards.

Mathematical Formulation of Leveraged Liquid Restaking

- Initial Stake on Lido:

- Stake 100 ETH on Lido.

- Receive 100 stETH.

- Conversion to ezETH:

- Send 100 stETH to Renzo Protocol.

- Assume the stETH price (ps) is 0.99 ETH & ezETH price (pr) is 0.66 ETH.

- The value of 100 stETH is equivalent to (100 x 0.99)/0.66 =150 ezETH.

- Restaking on EigenLayer:

- Renzo Protocol restakes your 100 stETH on EigenLayer.

- Returns depend on the AVSs selected.

- Using ezETH as Collateral:

- Use 150 ezETH as collateral on Aave v3.

- Value of this collateral is 150×0.66=99 ETH.

- Target LTV is 70%.

- Borrow 99×0.7=69.3 ETH from Aave v3.

- Total Value Staked on Lido = 217.32

- Total Restaked on EigenLayer = 217.32

- Funding Cost: Assuming a net interest rate of 10bps (0.1%): 100×0.1× ((0.99×0.7) + (0.99×0.7)^2+(0.99×0.7)^3) = 11.73 ETH

- Net Leverage: (2×217.32−11.73)/100= 4.23X

TVL Considerations

The TVL table explains how the reported TVL values can be misleading due to leveraged staking & restaking activities.

- True TVL: This is the actual amount of ETH originally deposited on Lido. True TVL on Lido: 100 ETH

- Artefactual TVL: These values represent the inflated TVL reported by different platforms due to leveraged staking & restaking.

They do not reflect the actual amount of new ETH deposited but rather the repeated use of the same ETH as collateral.

Observations on EigenLayer TVL:

- Restaking of native tokens: Should be counted as TVL because these are new deposits.

- Restaking of LSTs (Liquid Staking Tokens): Should not be counted as TVL because they do not represent new deposits but rather reused collateral.

- True TVL on EigenLayer: Should be two-thirds of the reported value since one-third of restakers are depositing LSTs.

Risks Associated with Leveraged Staking & Restaking

In lending protocols like Aave, the health factor & liquidation thresholds are crucial metrics for managing the risk of liquidations.

- Health Factor: This is a measure of the safety of a borrower's position. It is defined as the ratio of the value of the collateral to the value of the borrowed assets, adjusted for the liquidation threshold.

Health Factor= (Collateral Value×Liquidation Threshold)/Borrowed Value

A health factor greater than 1 indicates a safe position, while a health factor below 1 indicates that the position is at risk of liquidation.

- Liquidation Threshold: This is the maximum loan-to-value (LTV) ratio at which a loan can remain open. If the actual LTV exceeds this threshold, the loan becomes eligible for liquidation. The threshold varies by asset & is set by the lending protocol.

A depeg event occurs when the price of an LST deviates significantly from its peg (usually the native token it represents). For instance, if stETH (a liquid staking token for ETH) depegs from ETH, the value of the stETH collateral drops, increasing the LTV & reducing the health factor.

- Target LTV: The LTV at which the loan was originally taken.

- Actual LTV: The LTV after a depeg event, which can be significantly higher if the price of the LST falls.

When a borrower initially borrows ETH using stETH as collateral, the LTV is based on the current price of stETH relative to ETH. If stETH is worth 0.99 ETH, & the target LTV is 70%, the borrower can take a loan up to 70% of the value of their stETH collateral.

Suppose the price of stETH falls to 0.90 ETH. The value of the collateral drops, increasing the actual LTV. If the actual LTV exceeds the liquidation threshold, the health factor drops below 1, & the loan becomes eligible for liquidation.

When the health factor falls below 1, liquidators can step in to repay part of the debt & acquire the collateral at a discount. This creates a cascading effect:

- Initial Liquidation: The initial liquidation reduces the borrower's collateral, further increasing the actual LTV for the remaining loan.

- Cascading Liquidations: If the LST continues to depeg, more liquidations occur, potentially causing a downward spiral in the collateral value & further liquidations.

This risk of cascading liquidations due to depegs highlights the systemic vulnerabilities in leveraged staking strategies. Professional liquidators can exacerbate this risk by targeting positions close to liquidation thresholds, leading to significant market instability.

Risks Associated with Renzo Protocol

Renzo Protocol is a liquid restaking platform that allows users to restake their liquid staking tokens (LSTs) on EigenLayer. In return, users receive ezETH, a liquid restaking token. Renzo Protocol aims to enhance the returns from staking by leveraging the staking rewards from both Ethereum & EigenLayer.

Key risks associated with Renzo’s Liquid Restaking Token (ezETH) include:

- Market Risk: The value of ezETH is susceptible to price fluctuations. A significant drop in the price of ezETH relative to ETH can trigger liquidations, leading to a cascade of further price drops & liquidations.

- Operational Risk: Technological risks include smart contract vulnerabilities & the potential for errors in the implementation of restaking protocols. These risks can lead to losses for users & impact the stability of the protocol.

- Counterparty Risk: Renzo Protocol users are exposed to the risk of default by DeFi companies running actively validated services (AVSs) on EigenLayer. If an AVS fails to fulfill its obligations, restakers may face significant losses.

- Price Manipulation via Oracles: Manipulating the price oracle used to determine the value of ezETH can artificially inflate or deflate its price. For example, an attacker could inflate the supply of ezETH by manipulating its oracle price & then execute a dump on a decentralized exchange (DEX) with low liquidity, causing a sharp price drop.

- Rug Pulls & Liquidity Attacks: An intentional depeg event, such as a rug pull where a large holder suddenly sells a significant amount of ezETH, can create a liquidity crisis. This can lead to a sharp decline in ezETH price, triggering liquidations & further price drops.

- Credit Risks: Restakers assume additional credit risks associated with the default of DeFi companies running actively validated services (AVSs) on platforms like EigenLayer. These risks are often not well understood or managed, increasing the potential for losses.

- Double-Counting of TVL: The total value locked (TVL) in DeFi protocols can be overestimated due to the recursive nature of leveraged staking & restaking. For instance, the TVL reported on Renzo Protocol, Aave, & EigenLayer might include the same assets multiple times, inflating the perceived security & stability of these protocols.

There are several historical incidents where depegging of liquid staking tokens (LSTs) led to significant liquidations & broader market instability. Key examples include:

- stETH Depeg in June 2022: The depeg of stETH from ETH caused a cascade of liquidations, leading to the bankruptcy of major DeFi platforms like Celsius, Voyager, & 3AC. This incident was triggered by the Terra blockchain attack, which unintentionally affected the stETH-ETH pool on Curve.

- April 2024 Depeg Event: A more recent example involving the depeg of ezETH, Renzo’s liquid restaking token. This event caused a liquidation cascade on the Morpho liquidity protocol, highlighting the vulnerability of newer restaking protocols to similar systemic risks.

Depegging often leads to significant outflows from liquidity pools, exacerbating price declines & increasing the likelihood of further depegs. For example, if large amounts of stETH are dumped into a low-liquidity pool, it can drive the price down further, triggering more liquidations. DeFi protocols are highly interconnected, with many protocols relying on the same collateral types & liquidity pools. A depeg in one protocol can quickly affect others, as collateral values drop & health factors fall below safe thresholds.

Liquidators play a crucial role in this dynamic, as they are incentivized to identify & liquidate vulnerable positions. This can create a feedback loop, where initial liquidations lead to more depegs & further liquidations. A depeg in ezETH can have broader implications for the DeFi ecosystem. As leveraged restaking positions are liquidated, other collateral types & interconnected protocols can be affected, leading to a wider contagion effect.

How can Chainrisk help?

There are a couple of proposed approaches by the author of the paper itself such as developing optimization functions for optimal risk hedging between LSTs & LRTs & solving them. We could also use some particle filter methods like Monte Carlo & so on to simulate the depeg events & create the optimal parameters for AAVE & Renzo Protocol simultaneously to maintain a healthy coupled peg range using the ChainRisk Risk Platform itself. The area is ripe with research directions & there is ample space to innovate.

Conclusion

Leveraged staking & restaking can significantly amplify returns but also introduce substantial risks. Depeg risks & liquidation thresholds are critical factors that can trigger liquidation cascades & credit contagion. Detailed mathematical analysis & simulations can help quantify these risks, providing valuable insights for risk management. By using these detailed analyses, Chainrisk can demonstrate its capability to identify & mitigate economic risks associated with DeFi protocols like Renzo Protocol. The simulations & tools offered by Chainrisk can stress test these protocols under various market conditions, uncovering potential vulnerabilities before they are exploited.

References

- Leveraged Restaking of Leveraged Staking: What are the Risks?

- Renzo Protocol Docs

- EigenLayer Docs

- Renzo Restaked ETH Suffers a Brief Crash on Uniswap

- ETH2 Deposit Contract | ETH2 Insights Dashboard | Nansen

.svg)

.svg)

.svg)